Finding qualified employees can be a struggle in today’s competitive job market. But what if there was a program that incentivized you to hire talented individuals and offered tax breaks to sweeten the deal? Enter the Work Opportunity Tax Credit (WOTC) program.

This federal program isn’t just about saving businesses money; it’s about creating opportunities for those who might face barriers to employment. By offering tax credits for hiring individuals from specific target groups, the WOTC program aims to increase employment rates and reduce reliance on government assistance.

But who exactly qualifies for these tax credits? While veterans are a prominent group, the WOTC program offers benefits for a wider range of individuals. This blog will delve into the details of the WOTC program, explaining how it works and who can benefit. We’ll explore the target groups, the tax credit benefits for businesses, and the steps involved in claiming the credit. By the end of this post, you’ll understand how the WOTC program can be a win-win for your business and your community.

What Exactly is WOTC?

Have you heard the term WOTC in conversations centered around employment? The Work Opportunity Tax Credit (WOTC) is a federal program that incentivizes businesses to hire qualified individuals from groups that have historically faced barriers to employment. By offering tax credits to employers, the program aims to increase employment opportunities and reduce reliance on government assistance programs.

How WOTC Works

The Work Opportunity Tax Credit (WOTC) incentivizes businesses to hire veterans and individuals from other designated groups facing employment challenges. Businesses can claim tax credits for a portion of wages paid to these qualified employees. The program involves identifying eligible candidates, completing paperwork for certification, and meeting employment benchmarks. By offering tax breaks, WOTC aims to increase employment opportunities and reduce reliance on government assistance programs. Below we break it down into sections to help explain how each portion of WOTC works

Employment Target Groups: The WOTC program identifies specific groups of workers who qualify for the credit. These groups may include veterans, recipients of long-term unemployment benefits, young ex-offenders, or those living in empowerment zones (low-income communities). The idea is to help reduce the unemployment rate or underemployment rate of the people who make up these groups, specifically because they receive compensation when they are not working, from the government and that burden is offset when they have gainful employment. The government incentivizes employers to hire from these groups, for a win-win-win (individual, company, government) arrangement.

Employer Participation: Businesses interested in claiming the WOTC credit need to participate in the program through their state workforce agency. The agency will help identify qualified job candidates and provide certification paperwork. The WOTC credit is earned when candidates that fit the WOTC criteria are hired, and meet certain requirements we explain in the next section here.

Tax Credit: If a business hires a WOTC-eligible candidate and they meet certain employment benchmarks (like working at least 400 hours in the first year), the employer can claim a tax credit on a portion of the wages paid to that employee. The credit amount can vary depending on the target group and the employee’s wages.

To claim the full tax credit, the hired WOTC-eligible candidate must meet specific employment benchmarks. This typically involves working a minimum number of hours within a set timeframe (often 120 to 400 hours in the first year). Important to note that Employers need to maintain accurate documentation and complete the required WOTC forms for certification and claiming the tax credit and remain in compliance.

Benefits: There are advantages for both employers and employees. Employers receive tax relief, potentially reducing their tax burden. Employees gain valuable work experience and potentially higher wages. Additionally, the program can help them transition into stable employment and reduce reliance on government assistance.

How Walton Can Help You Automate WOTC

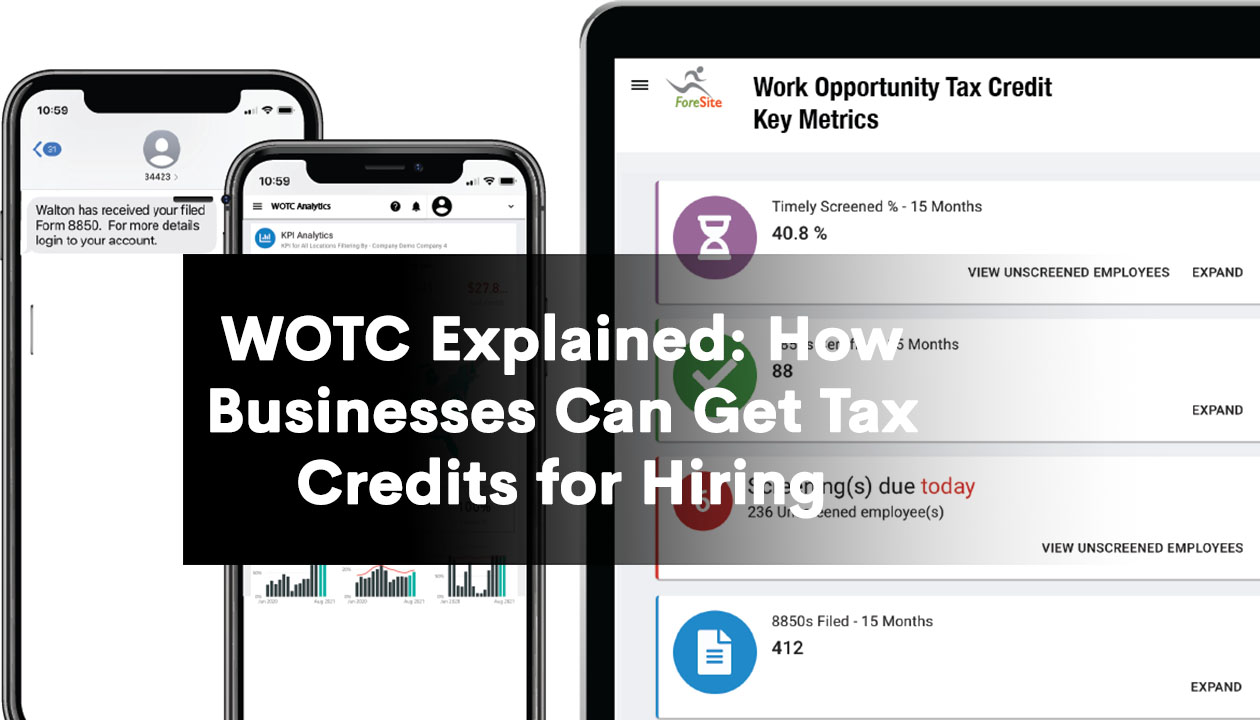

Feeling overwhelmed by the paperwork and complexities of the WOTC program? Don’t let that stop you from reaping the benefits of hiring qualified veterans and other target group members. Walton Management Services offers a powerful solution to streamline your WOTC process, saving you time and maximizing your tax credit opportunities.

Walton’s cloud-based system, NetCentives™, takes the manual work out of WOTC management. Here’s how it simplifies things for your business:

Automated Screening: Integrate NetCentives™ with your existing applicant tracking system (ATS) or onboarding platform. During the application or onboarding process, eligible candidates can be automatically flagged for WOTC screening. This eliminates the need for manual identification and saves valuable HR resources.

Seamless Workflow: NetCentives™ guides new hires through a simple online questionnaire to determine their WOTC eligibility. The system handles electronic signatures and secure filing of the critical Form 8850, ensuring compliance and reducing the risk of errors.

Effortless Data Management: Walton automates the transmission of payroll data directly from your HRIS system to the WOTC program. This eliminates manual data entry and ensures accurate credit calculations.

Advanced Reporting: Gain real-time insights into your WOTC program with NetCentives™ comprehensive reporting tools. Track hiring trends, monitor credit eligibility, and identify potential issues – all from a user-friendly dashboard. This proactive approach allows you to optimize your WOTC strategy and maximize your tax credit benefits.

By partnering with Walton Management Services, you can focus on attracting top talent and building a diverse workforce, while their automated system takes care of the WOTC paperwork and compliance. It’s a win-win for your business and the community you serve.