Tax season has a way of bringing small details to the surface. Forms you barely thought about all year suddenly matter a lot. If unemployment benefits were part of your year, even briefly, questions around paperwork tend to show up fast. Where the form comes from. Whether it’s the right one. And what happens if something doesn’t line up?

That’s where unemployment tax forms enter the picture. They connect the dots between wages, benefits, and how state unemployment insurance systems track what was paid and when. These forms help state agencies process UI Claims accurately and help employers keep unemployment claims management on track. When the paperwork is clear and timely, things move forward. When it isn’t, delays and confusion follow, and that frustration usually lands on both sides.

Understanding where to get an unemployment tax form is not just about checking a box for filing season. It’s about seeing how unemployment tax reporting feeds into state unemployment insurance, how claims are reviewed, and why proper documentation supports steadier outcomes over time, including how unemployment benefits are reported for tax purposes under IRS guidance on unemployment compensation.

Why unemployment tax forms show up in the first place

Unemployment tax forms usually appear because money moved through the system. Either wages were paid, benefits were issued, or both. State agencies need a clear record of that activity, and these forms are one of the main ways state unemployment insurance programs keep everything aligned. This is closely tied to why people in the U.S. pay unemployment taxes, which explains how employer reporting and benefit funding stay connected across state systems.

At a basic level, unemployment tax reporting ties pay history to benefit eligibility within the state unemployment insurance system. States rely on this information to determine benefit amounts, review eligibility, and track how claims affect employer accounts. Without accurate forms, state unemployment insurance decisions become slower and more difficult to manage.

Think of it like a shared ledger. Employers report wages. State unemployment insurance systems track benefit payments. UI Claims are reviewed against those records to confirm what was earned, what was paid out, and when. When the numbers line up, claims move smoothly. When they don’t, delays follow, and unemployment claims management becomes reactive instead of controlled.

This is also why unemployment tax forms tend to surface when people least expect them. A short layoff, a seasonal break, or a role that ends earlier than planned can all trigger benefit activity. Once benefits are paid through state unemployment insurance, documentation follows as part of the process, not as an extra step added later.

For employers, this connection matters over time. Repeated errors or missing information can affect how state unemployment insurance claims are reviewed and how unemployment tax costs show up year after year. Solid unemployment claims management starts with understanding why these forms exist and how they support the system behind them.

Where people actually get an unemployment tax form

Most confusion around unemployment tax forms comes from not knowing who holds the paperwork. It’s not always the same place, and it’s rarely the IRS directly. The source depends on what triggered the unemployment activity in the first place.

Start with the state

State unemployment insurance agencies are the primary source when benefits are paid. If someone received unemployment benefits, the state’s workforce or labor department usually issues the form through its online portal. That’s where UI Claims are recorded, reviewed, and tied back to reported wages. Because requirements and access can differ, it helps to understand how state unemployment insurance varies by state, especially when forms appear in different systems or timelines.

Online accounts matter more than mail now.

Many states no longer send everything by default. Forms are posted inside unemployment accounts, sometimes without a separate notice. Logging in matters. Checking message centers matters. This is one of the most common reasons forms get missed.

Employers still play a role.

Employers report wage data that feeds directly into state unemployment insurance records. When that information is late or incorrect, it can delay how unemployment tax details appear on the form. This is where unemployment claims management becomes more than a back-office task and starts to overlap with unemployment tax planning, since accurate reporting helps employers anticipate costs, avoid surprises, and stay ahead of future adjustments. It directly affects how clean or messy the paperwork looks later.

Timing depends on claim activity.

If UI Claims were filed early in the year, forms usually appear sooner. If claims were adjusted, appealed, or reviewed again, forms can show up later than expected. That delay isn’t random. It’s tied to how state unemployment insurance systems reconcile benefit payments with employer wage data.

This is also why people checking for a form too early sometimes come up empty-handed. The system needs time to match everything up. Knowing where to look helps, but knowing when to look matters just as much.

Why this paperwork matters more than it seems

On the surface, an unemployment tax form looks routine. Another document. Another checkbox during filing season. But the impact shows up later, often when people least expect it.

Even a small mistake can ripple outward. A delayed form can slow UI Claims review. A mismatch can trigger follow-up questions from the state. Over time, those small issues stack up and turn unemployment claims management into a reactive process instead of a controlled one. This is why many employers rethink unemployment claims management as a managed expense, not just an administrative task.

State unemployment insurance systems rely on clean data to work the way they’re supposed to. When the information is right, claims move faster, decisions feel fair, and employers avoid sudden cost spikes. When it isn’t, everything drags. More reviews. More notices. More back-and-forth.

Understanding this connection changes how the form is viewed. It’s no longer just a filing requirement tied to unemployment tax. It becomes part of how stability is maintained across claims, costs, and workforce planning.

That perspective makes a difference.

How verification and claims quietly shape the outcome

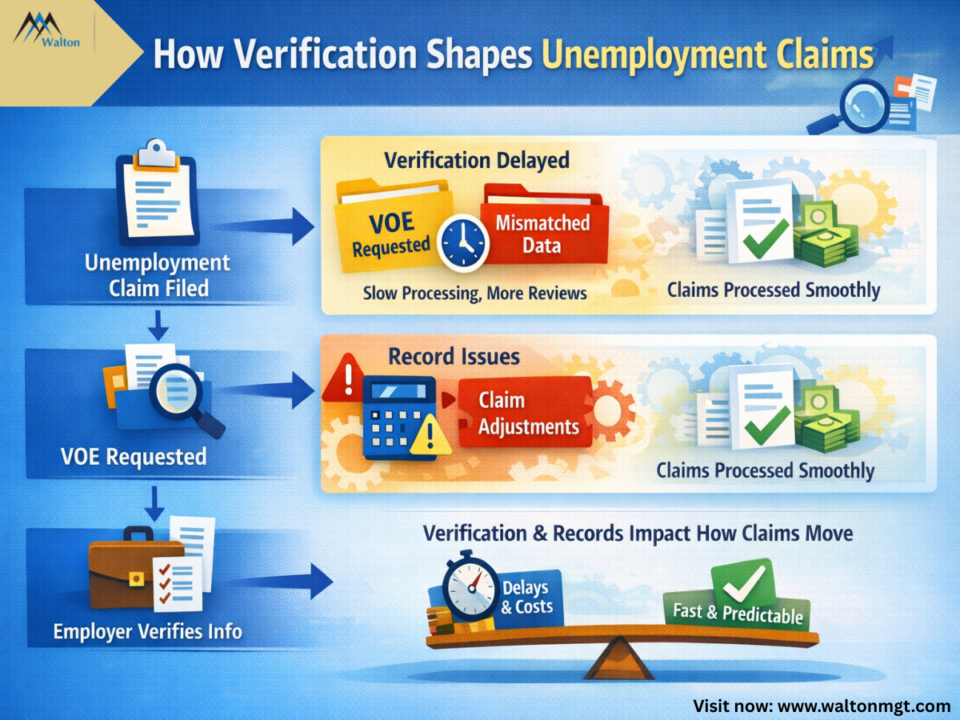

A lot of what affects unemployment paperwork happens behind the scenes. People don’t see it right away, but it shapes how claims move, how costs add up, and how state unemployment insurance decisions are made.

One of the biggest pieces in that process is Verification of Employment (VOE), which plays a key role in confirming work history and wage details tied to unemployment claims.

When a UI claim is filed, the state often needs confirmation of work history, wages, and separation details. That’s where VOE and UI claims intersect. If verification is delayed or incomplete, the claim slows down. If the data doesn’t match, the state reviews it again. And each review adds time and friction.

This is why unemployment claims management isn’t just about responding to notices. It’s about keeping records aligned so verification doesn’t become a bottleneck.

Here’s how the pieces usually connect in real life:

What’s happening | How it affects the process |

The UI claim is filed | State unemployment insurance reviews wage and job history |

Verification of Employment (VOE) is requested | Employer confirms dates, pay, and separation details |

VOE response is delayed or incorrect | UI claims review slows or triggers follow-up |

Records don’t match unemployment tax data | The claim may be adjusted or reviewed again |

Clean verification and records | Claims move faster, and costs stay more predictable |

None of this is dramatic on its own. But over time, small verification issues can stack up. More follow-ups. More administrative work. More exposure is tied to unemployment tax records and claim outcomes.

For employers, this is where consistent unemployment claims management pays off. Clean VOE responses, aligned records, and timely communication help state unemployment insurance systems process claims with fewer disruptions. It’s not flashy work, but it makes everything downstream easier.

Where cost, credits, and planning start to intersect

Unemployment costs rarely show up all at once

Unemployment-related costs usually don’t hit in one clean line item. They show up slowly, through repeated UI Claims, adjustments tied to state unemployment insurance, and follow-up reviews that stretch longer than expected. When forms, verification, and reporting are misaligned, those costs become harder to predict. The U.S. Department of Labor’s explanation of unemployment insurance financing outlines how benefit charges and employer experience ratings influence long-term costs.

This is where unemployment claims management starts to feel less like paperwork and more like cost control. Not in a dramatic way, but in a steady, practical one that shows up over time.

Why accuracy affects more than compliance

Accurate unemployment tax records help states calculate benefit charges correctly. They also help employers avoid paying for claims they shouldn’t be responsible for. Over time, that accuracy influences how unemployment costs trend year to year.

Planning beats reacting every time.

When employers understand how unemployment tax reporting, UI Claims, and state unemployment insurance interact, planning gets easier. Not perfect, but clearer. Fewer surprises. Fewer last-minute fixes.

That clarity matters when workforce changes happen quickly. Layoffs. Seasonal shifts. Restructuring. Employers who already have strong unemployment claims management processes in place tend to handle those transitions with less disruption and fewer long-term cost effects.

It’s not about chasing savings. It’s about avoiding avoidable problems.

How does this all tie back to workforce stability

When people think about unemployment paperwork, they usually think short-term. A form is needed for filing. A claim that needs a response. A deadline that’s getting close. But over time, these pieces shape something bigger.

State unemployment insurance systems don’t just look at one claim in isolation. They look at patterns. How often do claims appear? How quickly are they verified? Whether the unemployment tax reporting lines up with the wage history. Those patterns influence how costs trend and how predictable workforce changes feel from year to year.

This is where steady unemployment claims management quietly does its job. Clean records make claims easier to resolve. Clear verification keeps reviews shorter. Accurate reporting reduces the chance of surprise adjustments later. None of this eliminates risk, but it lowers the noise that makes workforce analytics and reporting more difficult than it needs to be.

When employers understand how these parts interact, decisions feel less reactive. Staffing changes don’t feel as disruptive. Costs feel more explainable. And conversations with state agencies tend to move faster, not slower.

That kind of stability doesn’t come from one perfect filing season. It comes from consistency over time.

Bringing it all together without overcomplicating it

Unemployment tax forms sit at the intersection of reporting, claims, and compliance. They reflect what happened, but they also influence what happens next. When those forms are easy to locate and accurately completed, state unemployment insurance systems can do what they’re meant to do. Process claims fairly. Track costs correctly. Keep things moving.

For employers, the benefit shows up in fewer surprises and clearer cost patterns tied to UI Claims. For people filing returns, it shows up as fewer delays and fewer follow-ups. When questions come up or support is needed, we at Walton Management are here to help. Everyone feels the difference when the system works the way it should.

This isn’t about mastering every rule or memorizing every form. It’s about understanding how the pieces fit together and why they matter beyond a single deadline. Once that connection is clear, the process stops feeling random and starts feeling manageable.

And honestly, that’s the goal.