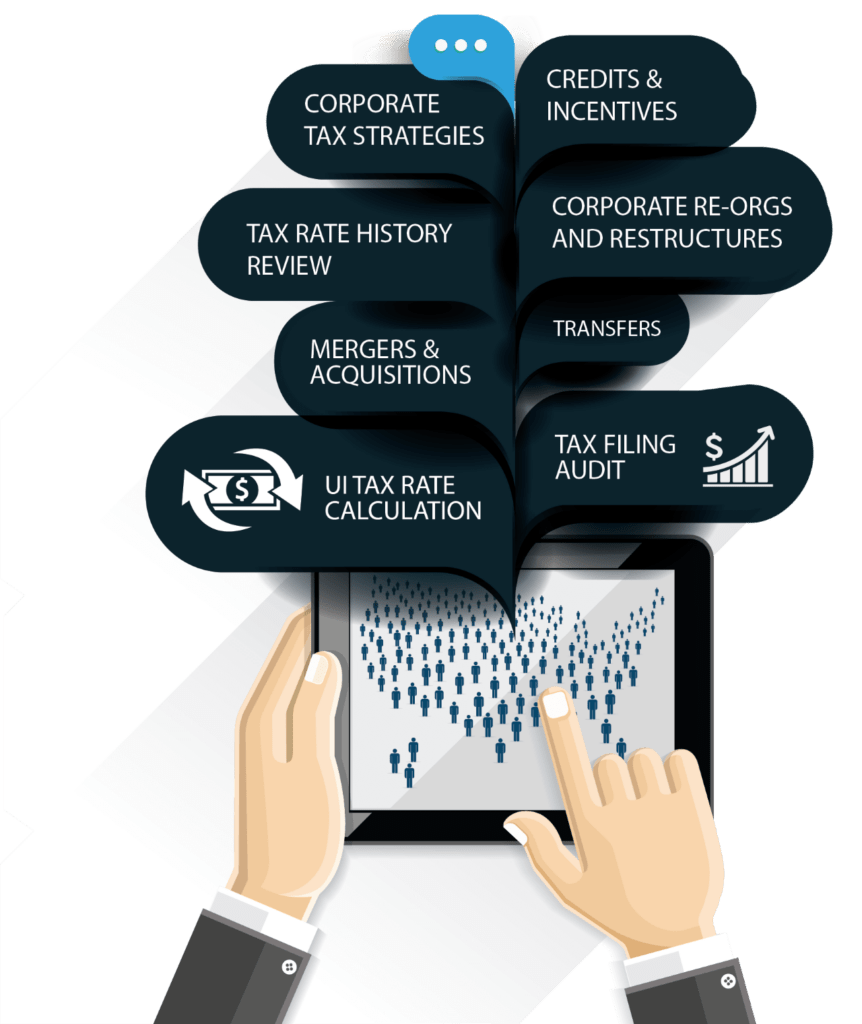

A Complete State Unemployment Tax-Planning Solution

Let’s face it. State unemployment taxes are one of the most complex elements of U.S. corporate taxation.

States administer tax-rate calculations through the Department of Labor and Revenue. Therefore, it can impact a company’s tax, payroll, finance and human resources function and utilize valuable resources. However, ensuring all state unemployment taxes are calculated and administered properly impacts a company’s bottom line and budget.

That’s where our solution comes in. Our experienced consultants will step in and conduct a comprehensive audit and review of your company’s structure to identify and implement best practices proven to streamline and optimize your company’s tax savings.

Domain Expertise

Our consulting partners bring hundreds of years of combined experience in corporate taxation and developing proven solutions to maximize your tax savings.

Unbeatable Results

We are confident we can deliver the most significant savings based on your goals, company structure, and unique needs.

World-Class Support

Our team takes the time to understand your business thoroughly to identify the best strategy and action plan to maximize your company's tax savings.

Professional UI Tax Planning

As an experienced unemployment insurance consultant, Walton specializes in UI Tax Planning, offering tailored solutions to businesses seeking to optimize their unemployment insurance tax rates across all states.

Our dedicated professionals are committed to guiding you through the intricacies of UI Tax Planning, ensuring your organization’s tax liabilities are minimized while staying compliant with state regulations. With our expertise, you can navigate through the complexities of unemployment tax rates with ease.

UI Tax Rate Validation and Optimization

Mergers and Acquisitions/Refund Studies

UI Statutory Elections

UI Tax Rate Projections

Internal Rating Allocation

Experience the confidence that comes with our UI Tax Planning expertise. Reach out to us today to start optimizing your unemployment insurance tax rates.

The Benefits of Turning UI Tax Planning to Walton

Expert Guidance:

Gain access to experienced professionals well-versed in UI Taxes and corporate tax planning strategies.

Unmatched Savings:

Efficient management of your company's UI Tax leads to potential tax savings and reduced unemployment costs.

Resource Efficiencies

Free up valuable internal resources by leaving complex unemployment claims to our experts.

Compliance Assurance:

Stay compliant with ever-changing unemployment insurance laws and regulations.

Tailored Solutions:

Receive customized solutions based on your business’s needs, goals and workforce requirements.

Proactive Strategies:

Implement proactive measures to minimize state unemployment claims and related expenses.

Keeps you Focused

We do the UI work, while you concentrate on your business's primary objectives, driving growth and profitability.

Risk Mitigation:

Reduce the risk of penalties and fines through accurate and compliant UI tax management.

UI Tax Frequently-Asked Questions

There are several savings techniques permitted by states to lower your unemployment tax rates. Account Audits, Voluntary Contributions, Joint Accounting, and Tax Planning for Mergers and Acquisitions (M&A) Events will be analyzed for every entity and throughout the year. All efforts are made to maximize savings and minimize cost.

There are 11 states that permit Joint Accounting, which is the combining of rating experience of commonly-owned entities. Voluntary Contributions, the process of paying into your reserve balance to move to a more favorable rating calculation, are allowed in 26 states. It is similar to buying points on your mortgage.

Yes. We can provide tax-rate forecasts for each active entity for the following year. We use all information available to give you an educated forecast of where your tax rate is headed next year. Utilizing the most up-to-date state legislation and your entities prior year’s tax-rating experience, we project your tax cost.

Yes. This is where proper unemployment tax planning is crucial. We can advise during the entire process and project the unemployment cost associate with the acquisition. We will analyze the type of transfer, asset or stock, and assure you are 100% compliant during the entire process. After reviewing the cost and ensuring compliance, we will secure any possible savings that may be available during the M&A event. This is where our expertise will provide a bottom-line value to the client.

You will have a dedicated account team that will be available 24/7. The team will be led by your Account Executive (AE) who is the overall relationship lead and your single point of contact. All discussions and questions can begin with your Account Executive. Your AE is supported by our Tax Director, Assistant Tax Director, and your lead tax analyst.