Introduction: The Headlines vs. Reality

President Donald Trump recently made headlines by firing the head and commissioner of the U.S. Bureau of Labor Statistics, Erika McEntarfer, over disputes regarding job numbers. This unexpected move has sparked public concern and raised questions about the health of the job market. Should businesses be alarmed?

The reality is less dramatic. According to the U.S. Department of Labor’s Unemployment Insurance (UI) Claims report, initial claims remained steady at 221,000, signaling that layoffs are not surging. Additionally, the Bureau of Labor Statistics’ July Employment Report shows the U.S. economy added 73,000 jobs, reflecting a slower, but stable, labor market.

For employers, this is not a time to panic but to focus on strategies that reduce unemployment costs and leverage tax credit opportunities. The job market is holding steady, but proactive planning is essential as growth shows signs of cooling.

What UI Claims Data Really Tells Us

Despite the headlines surrounding job numbers, the latest Unemployment Insurance (UI) Claims report from the U.S. Department of Labor paints a far calmer picture for employers. For the week ending July 26, 2025, initial claims stood at 221,000. This figure has hovered within the 215,000 to 225,000 range for several months, indicating that widespread layoffs are not occurring.

The four-week moving average, a key measure to smooth out weekly fluctuations, is at 220,750, showing minimal short-term volatility. The insured unemployment rate remains low at 1.2%, further suggesting that while job creation has slowed, those who lose jobs are still finding work relatively quickly.

For employers, these numbers are a sign to stay proactive. While UI claims are stable, even a small uptick in claims can impact a company’s State Unemployment Insurance (SUI) tax rates. Managing these claims effectively helps control long-term costs. Walton Management Services, powered by 40+ years of experience, specializes in assisting businesses with Unemployment Claims Management, ensuring claims are handled accurately to avoid unnecessary tax liabilities.

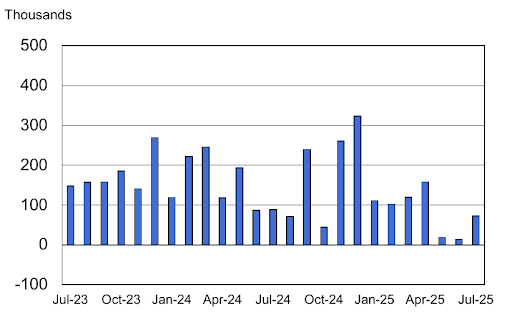

July Employment Report: Job Growth is Slow, But Not Collapsing

The Bureau of Labor Statistics’ Employment Situation Report for July 2025 shows that the U.S. economy added 73,000 nonfarm payroll jobs. While this number is modest compared to earlier periods of growth, it signals that the job market is cooling, not collapsing.

Nonfarm payroll employment over-the-month change,

seasonally adjusted, July 2023 – July 2025

The U.S. economy added 73,000 nonfarm payroll jobs in July 2025 (Source: Bureau of Labor Statistics’ July Employment Report)

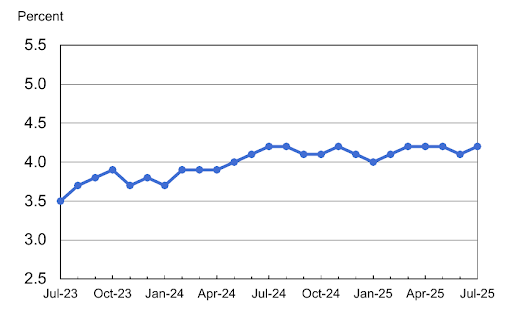

The unemployment rate remained stable at 4.2%, showing little change from previous months. Additionally, key metrics like the labor force participation rate, holding at 62.2%, indicate that while hiring is slower, the workforce remains steady. There’s no evidence of a spike in job losses or a surge in long-term unemployment that would indicate a crisis.

Unemployment rate, seasonally adjusted, July 2023 – July 2025

The unemployment rate remained stable at 4.2% (Source: Bureau of Labor Statistics’ July Employment Report)

For businesses, this slow-growth environment is a crucial time to shift focus. It’s not about bracing for a downturn, but about optimizing internal processes to manage costs effectively. Walton Management Services, a complete state Unemployment Tax Planning Solution, assists employers helping navigate potential SUI tax increases before they impact the bottom line.

A Quiet Opportunity: WOTC Tax Credits

While the job market remains stable, slower hiring and a rise in long-term unemployment present a unique opportunity for employers to capitalize on federal tax incentives. The Work Opportunity Tax Credit (WOTC) program offers businesses significant tax savings for hiring individuals from targeted groups, such as veterans, long-term unemployed, and SNAP recipients.

With the BLS reporting an increase of 179,000 in long-term unemployed persons and 275,000 new entrants seeking work, the pool of WOTC-eligible candidates is expanding. Employers who take proactive steps to screen for WOTC eligibility can reduce hiring costs and strengthen their workforce at the same time.

Walton Management Services simplifies the WOTC process by handling the screening, certification, and compliance, making it easy for businesses to capture these valuable credits. In a slow-growth environment, leveraging programs like WOTC can provide a competitive edge.

Why Job Data Can Appear Conflicting: Understanding the Metrics

One reason headlines often cause confusion is that job market data is complex and multi-layered. For instance, the Unemployment Insurance (UI) Claims report measures new claims filed for unemployment benefits, which reflects layoffs and job separations. On the other hand, the Employment Situation Report focuses on net job gains and workforce participation, offering a broader view of hiring trends.

It’s also important to understand that a stable unemployment rate does not always mean robust job growth. In periods of economic cooling, the number of people entering or leaving the workforce can mask underlying shifts. For example, a rise in long-term unemployed individuals may be offset by a decline in new layoffs, creating a picture of stability on the surface.

By looking at both UI claims and employment reports together, businesses and policymakers can gain a more accurate reading of the labor market’s health, rather than relying on isolated figures or political narratives.

Conclusion: Focus on Facts, Not Headlines

The firing of the Labor Statistics Chief by President Trump has sparked debates, but for employers, the real focus should be on what the actual labor data reveals. The latest Unemployment Insurance (UI) Claims report shows that layoffs remain low, while the Bureau of Labor Statistics’ Employment Situation Report indicates that job growth, though slower, continues at a steady pace. Together, these reports reflect a labor market that is stable, not collapsing, with no signs of mass layoffs or an immediate downturn.

For HR leaders, CFOs, and business decision-makers, this is a critical time to stay grounded. Instead of reacting to media noise, companies should prioritize strategies that control unemployment tax costs and capitalize on federal tax credits like WOTC. The labor market may not be in crisis, but proactive cost management is essential for staying competitive in a cautious economic climate.

By focusing on actionable data and strategic planning, businesses can navigate this period with confidence, regardless of political headlines.