Introduction

In today’s fast-paced business environment, manual payroll processes and outdated HR systems are no longer efficient or scalable. AI-powered automated payroll solutions are revolutionizing how companies manage hiring, payments, workforce management, and employee retention. These intelligent systems reduce errors, improve compliance, and free HR teams to focus on strategic growth.

By integrating with automated HR solutions, these payroll solutions provide seamless workflows that streamline hiring, automate payments, enhance management accuracy, and boost retention rates. Let’s explore how AI is transforming each of these critical business areas.

What Are AI-Powered Payroll Solutions?

AI-powered automated payroll solutions use machine learning, data analytics, and automation to handle payroll tasks with minimal human intervention. Unlike traditional payroll solutions, these advanced systems learn from historical data to predict and prevent errors, ensure compliance, and optimize payroll workflows in real time.

Key features of AI-powered payroll solutions include:

- Automated tax calculations and updates: These systems continuously update tax rules and automatically apply them to payroll calculations, minimizing human error and ensuring compliance.

- Real-time payroll processing: Payroll is processed instantly as data is received, reducing delays and providing up-to-date payment information.

- Fraud detection and anomaly alerts: AI algorithms detect suspicious payroll activities or inconsistencies to prevent fraud and errors before they affect the business.

- Seamless integration with automated HR solutions: These payroll systems connect smoothly with HR platforms to synchronize employee data and reduce duplicate work.

Related Article: Top Payroll Mistakes & How Automated Payroll Solutions Can Fix Them?

Improving the Hiring Process with Automation

The hiring and onboarding process is often bogged down by paperwork and manual data entry. AI-powered automated payroll solutions integrated with automated HR solutions streamline these processes, reducing errors and speeding up employee onboarding.

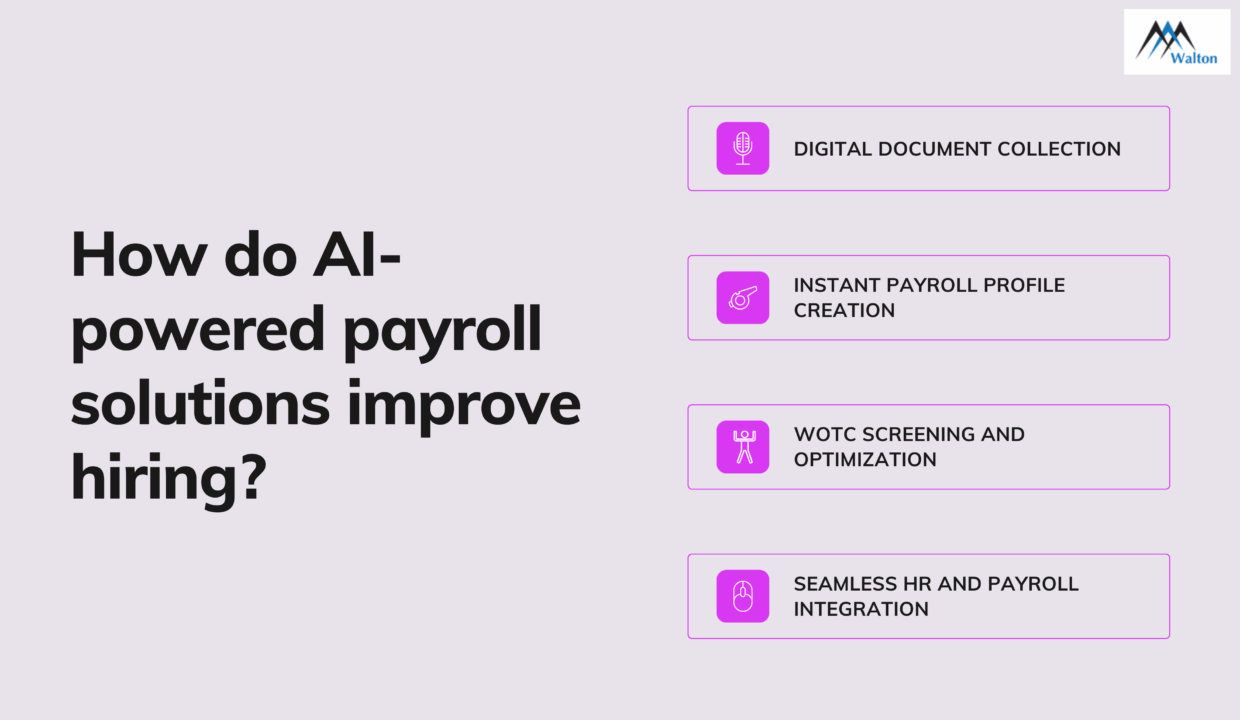

How do AI-powered and Automated payroll solutions improve hiring?

- Digital document collection: Automates gathering and verification of tax forms (W-4, I-9) and banking details. This eliminates manual paperwork, ensuring all necessary documents are accurate and complete before payroll processing begins.

- Instant payroll profile creation: New hires are automatically added to the payroll system from day one. Automation ensures employees can be paid on time without waiting for manual setup, speeding up the onboarding timeline.

- WOTC screening and optimization: AI screens candidates for Work Opportunity Tax Credit eligibility, maximizing tax savings for employers. This proactive tax credit screening helps businesses identify eligible hires and reduces overall tax liabilities.

- Seamless HR and payroll integration: Ensures data consistency across systems without manual entry. Integrated systems prevent data duplication and errors, improving overall accuracy and efficiency.

Benefits:

- Faster onboarding, reducing time-to-productivity: New hires become productive sooner thanks to streamlined hiring and payroll processes.

- Compliance with government regulations: Automated checks ensure all legal and tax requirements are met during hiring.

- Reduced administrative burden on HR teams: HR professionals can focus on strategic activities instead of paperwork.

- Improved new hire experience with quick setup: Smooth onboarding leaves a positive first impression on employees.

Enhancing Payroll Accuracy and Speed

Traditional payroll systems are prone to human errors, missed deadlines, and compliance risks. AI-powered automated payroll solutions automate complex calculations, ensuring employees are paid accurately and on time every pay cycle.

What are the key advantages of automated payroll solutions for payments?

- Real-time wage and tax calculations: Includes bonuses, commissions, overtime, and deductions. This ensures all components of employee compensation are calculated precisely, reducing payroll errors.

- Automated tax filings: Ensures federal, state, and local tax compliance with minimal effort. Taxes are filed correctly and on schedule, avoiding penalties and audit risks.

- Flexible payment schedules: Supports weekly, biweekly, monthly, or on-demand pay. Businesses can offer flexible pay options to accommodate diverse workforce needs.

- Instant payslip generation: Employees can access detailed payment info anytime via self-service portals. This transparency improves employee trust and reduces payroll-related inquiries.

Benefits:

- Elimination of costly payroll errors: Automated checks catch and correct mistakes before payments are processed.

- Enhanced compliance with tax regulations: The system stays updated with the latest laws to keep your business compliant.

- Reduced payroll processing time: Automation accelerates the entire payroll cycle, freeing up valuable HR resources.

- Improved employee trust and satisfaction with transparent payments: Accurate and timely payments increase employee confidence in payroll management.

AI-Powered Workforce Management

Effective workforce management goes hand in hand with payroll accuracy. AI-driven automated HR solutions integrated with automated payroll solutions allow organizations to optimize scheduling, attendance tracking, and labor cost management.

How AI is transforming workforce management?

- Attendance and time tracking: Biometric or digital time clocks integrate directly with payroll systems to ensure accurate tracking of hours worked. This automation helps eliminate manual entry errors and supports precise wage calculations. Additionally, AI can analyze timesheets to identify patterns, such as employees who may benefit from additional support or engagement strategies.

- Smart scheduling: AI predicts staffing needs and prevents overtime violations by balancing shifts. Optimized schedules reduce labor costs and improve employee work-life balance.

- Labor cost forecasting: AI helps analyzing Real-time analytics to forecast labor expenses and optimize budget allocation. Managers can proactively control costs while meeting staffing requirements.

Benefits:

- Greater operational efficiency and productivity: Automated processes free managers from administrative tasks and allow focus on business growth.

- Compliance with labor laws and overtime policies: The system enforces rules to avoid legal penalties and ensures fair labor practices.

- Reduced administrative workload for HR and finance teams: Automation cuts down repetitive manual tasks, improving accuracy and speed.

- Unified data for strategic decision-making: Comprehensive dashboards provide actionable insights across HR and payroll functions.

Supporting Employee Retention with Smart Payroll

Payroll accuracy and transparency significantly impact employee satisfaction and retention. AI-powered automated payroll solutions contribute by ensuring employees are paid correctly and have easy access to their compensation details.

Ways AI-powered automated payroll supports retention:

- On-time, accurate payments eliminate payroll disputes. Consistent, correct payments reduce frustration and build trust among employees.

- Self-service portals allow employees to view pay stubs, benefits, and time-off balances. Easy access to information empowers employees and reduces HR inquiries.

- Personalized benefits management adapts to employee needs dynamically. Automation enables customization of benefits, increasing employee satisfaction.

- Engagement analytics help identify employees at risk of leaving, enabling proactive retention strategies. Data-driven insights enable HR to address concerns before turnover occurs.

Benefits:

- Improved employee trust and morale: Transparent payroll fosters a positive workplace culture.

- Reduced turnover and recruitment costs: Retaining employees saves money and preserves institutional knowledge.

- Enhanced financial transparency: Clear payroll and benefits information builds confidence among staff.

- Better alignment of compensation with employee expectations: AI helps ensure pay and benefits remain competitive and fair.

Why Choose Walton Management’s Integrated HR Automation Solutions?

Walton Management, through its subsidiary Quentelle LLC, offers comprehensive AI-powered automated HR solutions designed to meet modern business challenges. Our platform seamlessly integrates automated HR software to provide end-to-end workforce management.

Walton Management’s key features include:

- Fully automated payroll processing with real-time tax compliance: Ensures your payroll runs smoothly and always adheres to tax regulations.

- Integrated WOTC screening to maximize your tax credits: Unlock valuable tax incentives effortlessly through automated candidate screening.

- Flexible, scalable solutions tailored for small to enterprise-level businesses: Our platform adapts to your growing business needs, ensuring long-term value.

- User-friendly dashboards providing actionable workforce analytics: Access insights and reports that help you make informed business decisions.

Conclusion

AI-powered automated payroll solutions are no longer a luxury, they are essential for businesses aiming to improve hiring efficiency, payment accuracy, workforce management, and employee retention. By leveraging AI and integrating with automated HR solutions, companies can reduce costs, ensure compliance, and create a better employee experience.

Walton Management’s automated HR solutions are the smart choice to future-proof your business. Contact us today to streamline your payroll and HR processes, boost productivity, and retain top talent.