Introduction

Managing tax credits is a valuable yet often underutilized financial opportunity for many businesses in the U.S. These incentives offered by federal and state governments are designed to encourage employment growth, support workforce diversity, and reduce tax burdens. However, navigating the complex landscape of tax credit programs can be tedious, especially when done manually.

That’s where modern Automated HR solutions come into play. By integrating tax compliance tools with workforce management systems, businesses can simplify the entire process, from identifying eligible hires to filing accurate claims. Programs like the Work Opportunity Tax Credit (WOTC) can yield substantial savings, but without streamlined tracking and data integration, many employers either miss out or fail to meet compliance requirements.

Why Tax Credit Calculations Are Complicated

Although tax credits are lucrative, calculating and claiming them can be labor-intensive. Here’s why:

- Multiple Credit Programs: Businesses may be eligible for several types of tax credits, such as the Work Opportunity Tax Credit, Empowerment Zone credits, Indian Employment Credit, and disaster relief credits. Each has different rules and requirements.

- Eligibility Tracking: Employees must meet specific criteria to qualify for a tax credit. For example, WOTC eligibility requires employers to verify if a new hire is a member of a target group, such as veterans, individuals on public assistance, or the long-term unemployed.

- Strict Deadlines: Filing for programs like WOTC requires submitting IRS Form 8850 within 28 days of the employee’s start date. Missing the deadline means forfeiting the credit.

- Manual Documentation: Without automated systems, tracking employment dates, verifying documentation, and generating reports becomes time-consuming and prone to human error.

These complexities create a barrier for businesses, especially those with high turnover or seasonal hiring patterns. This is where automated HR solutions become invaluable.

The Role of Integrated HR Solutions in Simplifying Tax Credits

Integrated HR solutions unify various workforce functions, such as recruiting, onboarding, payroll, and compliance, into a single platform. When these systems are connected with tax compliance tools, the result is a seamless process for identifying, capturing, and maximizing tax credit opportunities.

For example, as soon as a new employee is onboarded, the system can automatically screen for WOTC eligibility based on their background information. If eligible, the HR solution generates and submits the necessary forms within the required timeframe, ensuring compliance and accuracy.

Key ways integrated systems simplify tax credit calculations:

- Automated Eligibility Screening: Employees are screened during the onboarding process to determine if they qualify for programs like WOTC.

- Real-Time Data Sync: Payroll and onboarding data sync seamlessly with compliance tools, allowing real-time updates on tax credit status.

- Centralized Documentation: All necessary forms and supporting documents are stored in one location, easily accessible for audits or reporting.

- Compliance Monitoring: Alerts and reminders help businesses stay ahead of deadlines and reduce the risk of errors or omissions.

Related article: The Hidden Costs of Manual WOTC Management

Key Features That Make Integration Effective

What sets a high-performing HR solution apart is its ability to manage and automate complex compliance tasks. When it comes to tax credit processing, some of the most impactful features include:

- WOTC Screening During Onboarding: During the recruitment and hiring stage, the system automatically checks if a candidate belongs to a target group eligible for the Work Opportunity Tax Credit. This ensures that every qualifying opportunity is captured without delay.

- Smart Dashboards for Credit Tracking: Visual dashboards show the status of pending, approved, and denied tax credit claims, helping HR teams stay organized and focused.

- Automated Form Generation and Submission: IRS and Department of Labor forms related to WOTC and other credits are pre-filled and electronically submitted, reducing the risk of missed deadlines.

- Audit-Ready Reports: In the event of a compliance audit, employers can instantly pull up documentation, approval letters, and filing history.

- Integrated Payroll and HR Data: Combining payroll systems with HR solutions allows for accurate wage tracking, essential for calculating the exact value of each tax credit.

With these features in place, businesses are not just saving time, they’re ensuring they receive every dollar they’re eligible for.

Benefits for Employers

By integrating HR solutions with tax credit systems, businesses enjoy a wide array of operational and financial benefits:

- Significant Cost Savings: Programs like WOTC can offer up to $9,600 per eligible hire. With automated screening and filing, businesses can capture more credits and boost their bottom line.

- Fewer Compliance Errors: Manual processes are prone to mistakes, especially in high-volume hiring environments. Integrated HR solutions ensure compliance with filing deadlines and documentation requirements.

- Reduced Administrative Burden: HR teams can focus on strategic functions instead of spending time on paperwork and repetitive tasks.

- Improved Hiring Strategy: Data from tax credit programs can guide hiring strategies. For example, employers might prioritize hiring from target groups that qualify for WOTC, aligning their talent goals with financial benefits.

- Enhanced Reporting & Audit Readiness: With all records stored and tracked digitally, responding to IRS or Department of Labor audits becomes easier and faster.

Walton Management’s Integrated Tax Credit and HR Solutions

Walton Management offers a cutting‑edge platform to optimize tax credit processing by embedding automated HR solutions directly into every step of your hiring and payroll workflow. Our unified system ensures you capture every dollar of Work Opportunity Tax Credit (WOTC) for which you qualify, without manual tracking or missed deadlines.

Key Features of Our Platform

- Seamless WOTC Screening Integration: Every new hire is automatically screened for Work Opportunity Tax Credit eligibility at onboarding, so you never miss a qualifying candidate.

- Instant Form 8850 Submission: Form 8850 is electronically signed and filed with the State Workforce Agency within the required 28‑day window from the employee’s start date, guaranteeing you meet the deadline every time.

- Payroll and Data Sync: Wage and hour data flows directly from your payroll system into our platform, providing the exact information needed to calculate your tax credit value.

- Real‑Time Credit Monitoring: Our dashboards track each WOTC application from submission through approval, giving you full visibility into your tax credit pipeline.

- Customizable, Audit‑Ready Reports: Generate and export the precise reports you need, complete with filing history and documentation, so you’re always prepared for an audit.

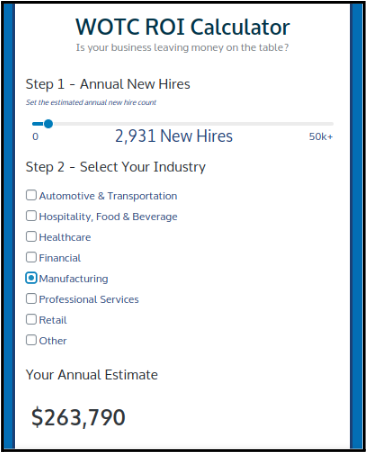

Estimate Your Savings With Our WOTC Calculator

Let our WOTC Calculator instantly show your savings potential using real-time, industry-specific benchmarks. Curious about how much your company could save? Try our calculator today and discover the true value of integrated HR solutions.

Conclusion

The path to maximizing tax credit savings doesn’t have to be complicated. With integrated HR solutions, businesses can overcome the traditional barriers of eligibility tracking, form submissions, and compliance management.

Whether you’re focused on the Work Opportunity Tax Credit or a broad portfolio of government incentives, Walton Management provides the automated HR technology and expertise to make the process smooth, scalable, and profitable. Contact us to leverage integrated HR solutions to help you save time and reduce costs, and claim every dollar you deserve.