Overview of the COVID ERC

The Employee Retention Credit is a temporary program originally established under The Coronavirus Aid Relief and Economic Stimulus Security Act, known as the CARES Act on March 27, 2020 in response to the economic fallout caused by the COVID-19 pandemic in the United States. Due to the prolonged impact the pandemic continues to have on the economy, The Consolidated Appropriations Act of 2021, enacted December 27, 2020 extended and modified the ERC program, so that qualified employers can apply to claim the benefit in 2021 in addition to 2020.

General ERC Qualifications

Non-Essential Businesses

Suspended Due to Mandates

Significant Decline in Gross Receipts

Kept Employees on Payroll

Essential businesses may qualify for ERC in instances where the business operation was severely disrupted as a result of the pandemic.

Sample of the Savings Produced by Walton

$1,000,000+

Fortune 500 Manufacturer

$300,000+

Regional Staffing Company

$800,000+

Janitorial Services Company

$600,000+

Regional Restaurant Chain

$2,000,000+

Automobile Dealership

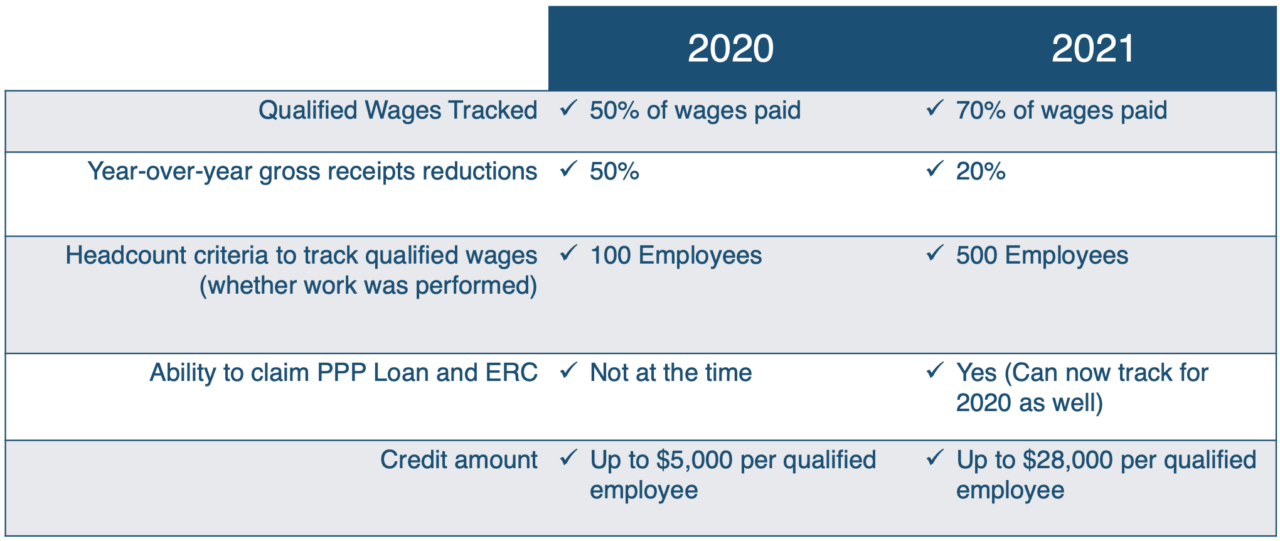

Year-over-Year ERC Benefit Details